Personal Tax Identification Number is a unique tax identification number for the purpose of declaring all income. No matter how much income an employee has, as long as they have income from wages and salaries, businesses are required to register a tax code for employees before finalizing tax. Please refer to the fastest way to Register and Look Up Personal Tax Code Online through the following article.

Is registration for a personal tax number mandatory?

According to Circular 166/2013/TT-BTC, in cases where enterprises intentionally fail to register personal MST for employees, they will be fined up to 2,000,000 VND, specifically:

- A warning will be imposed on cases of submitting tax registration dossiers within 1-10 days after the deadline, if there are extenuating circumstances.

- A fine ranging from VND 700,000 to VND 1,000,000 shall be imposed for submitting a tax registration dossier 1-30 days past due.

- A fine ranging from VND 1,400,000 to VND 2,000,000 shall be imposed if the tax registration dossier is overdue for more than 30 days, if there are extenuating circumstances, the minimum fine is VND 800,000.

In case an employee is not registered for a personal tax code, his or her benefits will be greatly restricted: Individuals must finalize personal income tax by themselves, no deductions for family circumstances for dependents, no refund personal income tax with overpaid tax…

Thus, to protect the interests of employees, each individual employee will be registered with a unique personal tax code.

How to register for a personal tax code?

Personal tax identification number is a sequence of 10 or 13 digits and other characters issued to taxpayers by the tax authority for tax administration. To register a personal tax code for employees, businesses can use one of the following two simple and quick ways:

- Register your personal tax code on the website of the General Department of Taxation. This method is often used when businesses register individual MST for a few people.

- Register your personal tax code right on the declaration support software (HTKK), export the XML file and then submit it through the portal of the General Department of Taxation.

Note: Individuals can also easily and quickly register their own personal tax identification number on the website of the General Department of Taxation. In addition, to successfully register for a personal tax code, one of the prerequisites is to have a digital signature.

How to register for a personal tax code online simple and fast

How to register for personal MST Online directly on the portal of the General Department of Taxation. In this way, you follow the steps below:

Step 1: Access the portal of the General Department of Taxation

In this step, you will access the portal of the General Department

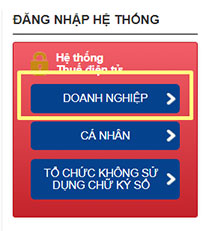

Step 2: Log in to the system

To be able to register a personal tax code for employees of the business, you click on the box “Enterprise” in the right corner of the screen, or in the case of self-registration, click on the box “Personal”.

Next, the system will display the interface “Login to the system”, you just need to fill in the “Username”, “Password” and select “Object” as “Taxpayer”.

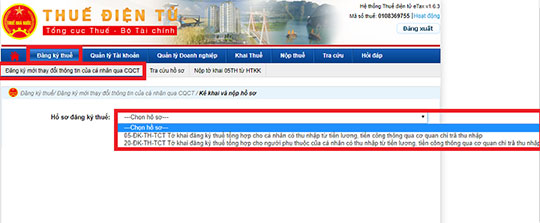

Step 3: Select the function “Register for tax”

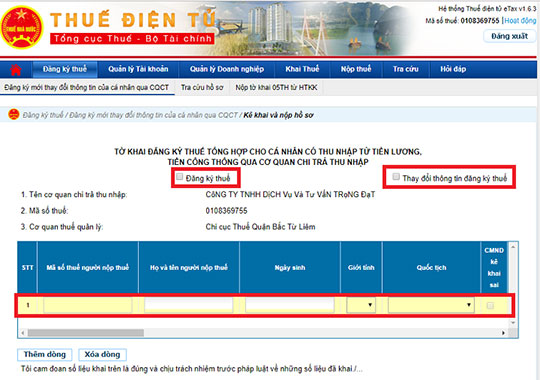

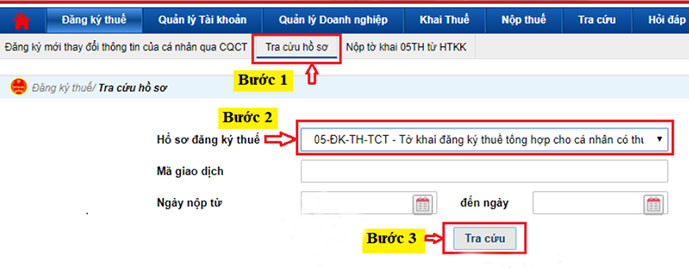

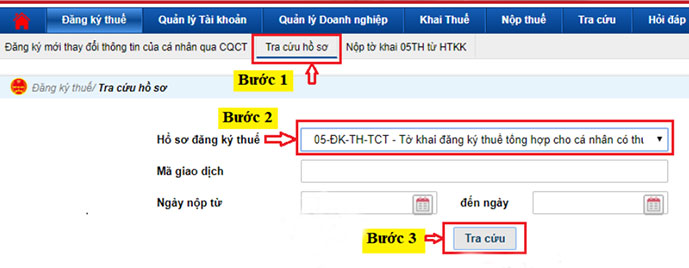

After successfully logging into the system, on the main interface of the page, click on the “Tax registration” function, select “New registration to change personal information via CQT” then select the profile “05-DK-TH-TCT”.

Step 4: Fill in the personal tax identification number registration form and submit the declaration

After selecting, the interface “General tax registration declaration for individuals earning income from salaries and wages through the income-paying agency” will be displayed, your job is to fill in the required information. Information needed to complete the declaration:

- First, you need to check the box “Register for tax”

- Then you correctly enter the information of the employee who needs to register for a personal tax code according to their identity card or identity card in the declaration of each box. If you want to register for 2 or more people, you can click on the “Add line” box.

- Next, enter the “Signing date” and enter the name of the business director in the “Legal representative” field.

- Finally, you click the box “Complete declaration”, click “Submit tax registration file” to complete the registration of personal tax identification numbers for your business employees.

Normally, the results of successful personal tax identification number registration will be returned in about 20 minutes. Therefore, you can easily check the results of the day by clicking on the “Tax registration” function, clicking “look up records”.

Thus, you have completed the personal tax identification number registration process on the portal of the General Department of Taxation.

The fastest way to look up personal tax codes

There are 2 ways to look up the fastest personal tax code.

Method 1: Look up personal tax code by ID/CCCD number:

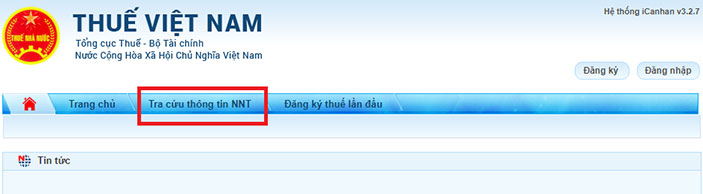

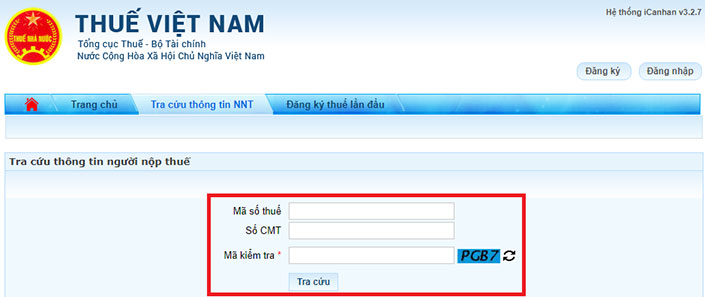

Step 1: Access the information page of

Step 2: Enter ID/CCCD number and confirmation code. Then click Lookup.

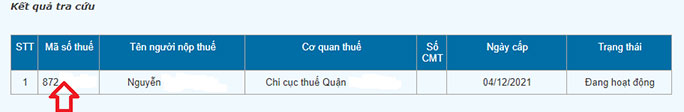

Step 3: View personal tax code

* Method 2:

Step 1: Access the Tax Department’s electronic tax page

Step 2: Choose an individual

Step 3: Select Look up NNT . information

Step 4: Enter ID/CCCD number and confirmation code. Then click Lookup.

Step 5: View personal tax code.

Tiếng Việt

Tiếng Việt